Boost Your Collections with the Best Debt Collection Software

Forgo spreadsheets, reduce call drops and embrace efficiency with telecrm’s debt collection software!

Debt collection domain header

What is

debt collection software?

Debt collection software streamlines and automates the recovery of owed payments. It acts as a central hub for managing all aspects of debt collection, from sending reminders to debtors to tracking account statuses and facilitating secure online payments.

- Automate payment reminders

- Track the entire debt collection journey

- Assign tasks and assess the performance of your debt collectors

Why do you need debt collection software?

Chasing outstanding invoices can be a frustrating and time-consuming process. Manual methods like spreadsheets and phone calls are inefficient and can leave room for errors. A debt collection software automates repetitive tasks, centralises information and helps manage your debt collection process.

Boost recovery rates

Automated communication and follow-ups ensure you never miss an opportunity to collect.

Reduce costs

Streamlined workflows and automated tasks minimise your operational expenses.

Improve efficiency

Free up your team's time to focus on core business activities while the software handles the heavy lifting of debt collection.

Gain valuable insights

Data-driven reports provide valuable insights into collection performance, allowing you to identify trends and make informed decisions.

Track agent performance

Gain real-time insights into agent call activity, including call volume, duration and outcomes.

Minimise defaults with history tracking

Track every interaction with a debtor in one place, including WhatsApp messages, calls, notes, follow-ups, emails and payment history.

Book a free Demo!

Book nowTop features in debt collection software that simplify the collection process

Centralised Debtor Database

Hassle-free onboarding

Because collecting debts shouldn't start with data headaches

- Migrate your existing debtor information from spreadsheets or other software with ease

- Our system automatically identifies and eliminates duplicate entries, ensuring data accuracy from the start

Telecalling Management

Make more accurate calls, faster

Because the time spent in manually dialling numbers can be used to make more calls instead

- Auto dial your leads in sequence without dialling a single number

- Use click-to-call to call your leads directly from the web application

- Integrate with platforms like Maqsam, Mcube, Knowlarity and CallerDesk for automatic call distribution

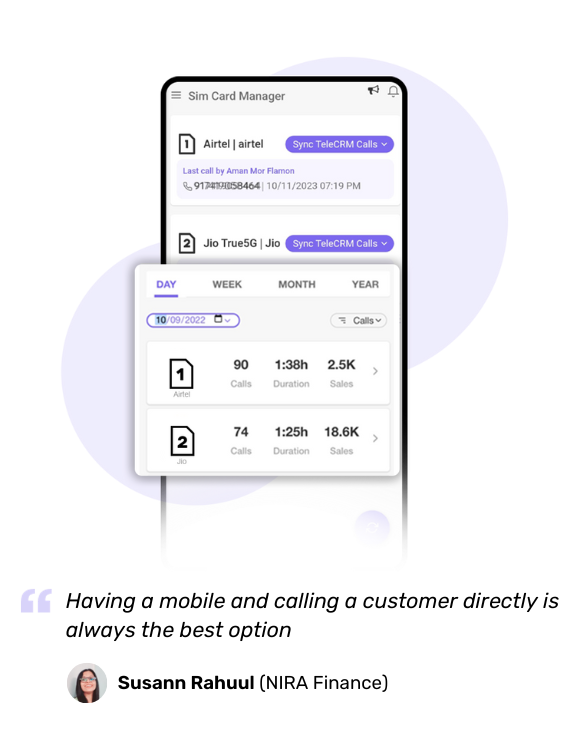

SIM-Based Dialer

Get better connectivity with SIM-based dialer

Because unreliable connections can lead to missed opportunities to collect

- Improve connectivity by reducing call drops

- Instantly connect with customers directly on their number

- Avoid Truecaller spam marking by using a new SIM card

Automatic Follow-Up Reminder

Never miss follow-ups

Because missed follow-ups = bad debts

- Schedule a call reminder so your agent remembers when to follow up

- Your agent gets notified when it's time for the call

Debtor Management

Simplify your collections workflow

Focus on recovering debt, not managing spreadsheets

- Access all debtor details, communication history, account statuses, documents and notes in one central location

- Categorize debtors based on loan ID, urgency, delinquency stage and potential for recovery

- Track payment status and integrate with platforms like Razorpay

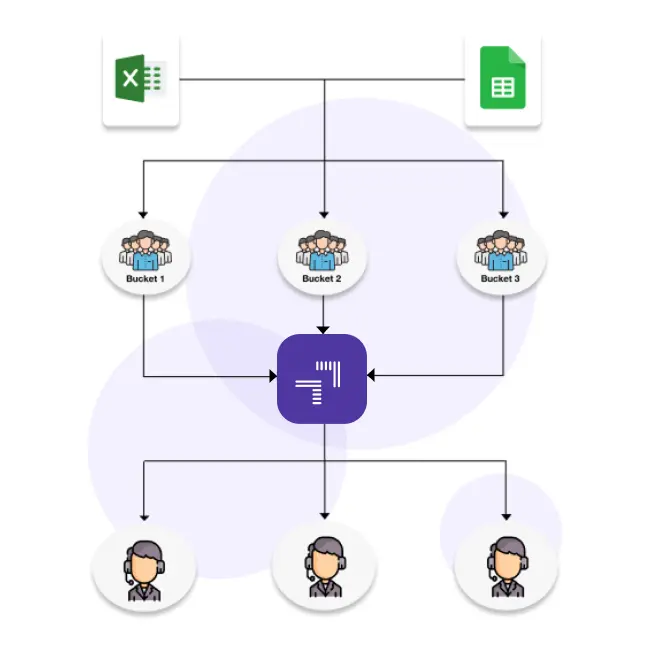

Team Management

Manage allocations of all callers remotely

Focus on growing your business instead of expending all your energy briefing your agents

- Assign tasks, define the level of responsibility for each member of your calling team from one location

- Categorise leads into custom loan buckets based on where they are in the debt collection journey

- Bulk distribute cases to assignees based on pre-defined logic

WhatsApp Cloud API

Use WhatsApp for debt collection

Because not every debtor picks up calls, and WhatsApp has a read rate of 100%

- Sync all your team members' WhatsApp conversations from within telecrm

- Run WhatsApp automation to send scheduled reminders at regular intervals

- Deploy a chatbot to resolve common queries and to direct the debtor to the right agent

Automatic Call Recording

Track your team effortlessly

Because you need to know what your agents are doing in real-time

- Automatically record every call your agents make

- Revisit calls from anywhere to see how your agents are performing

- Use the recordings as a learning resource to train your agents

Real-time Performance Insights

Make informed decisions

Because you need data on debt collection to ensure both your agents and your strategies are working or make changes if they aren't

- Get real-time data on debt collection, call volume, number of defaults, etc

- Generate custom reports based on metrics of your choice to track your agents’ performance

Why choose telecrm as your debt collection software

Mobile application

Manage accounts, access debtor information and initiate communication from anywhere with the telecrm mobile app

Pocket-friendly

A comprehensive list of debt collection features at an unmatchable price

Ease of use

Get started with telecrm in under a day thanks to its user-friendly interface that barely requires any training

Intuitive customer support

Avail personalised support through Zoom meetings, calls and a dedicated WhatsApp support group to resolve your queries promptly

Customisability

Design custom workflows based on debtor type, delinquency stage and communication preferences for optimal results

WhatsApp CRM

Get complete debtor overview by consolidating all communication channels – phone, email, text messaging and WhatsApp – into one interface

Book a free Demo!

Book nowFAQs

Can’t find what you are looking for? Drop a message on our WhatsApp number.

- Automated workflows: Schedule and send reminders automatically, ensuring timely follow-up with debtors AND allowing you to focus on what's important: devising collection strategies to boost debt collections

- Centralised debtor management: Get an overview of debtor details, communication history, account statuses, notes and documents from one location to speed up tasks

- Streamlined communication: Utilise multiple communication channels like phone, WhatsApp, email and text to reach debtors conveniently

- Improved agent efficiency: Free up your team from manual tasks, allowing them to focus on personalised communication and complex cases

- Data-driven insights: Generate reports to track the performance of collection agents and identify recovery rate, default rate etc to make informed decisions

- telecrm: Known for its affordability, user-friendliness and comprehensive features like automated workflows, centralised debtor management and data-driven insights, telecrm offers a strong balance of power and ease of use, making it a great choice for businesses of all sizes

- Chetu: It offers custom software development, allowing you to build highly customised debt collection solutions tailored to your unique workflows and functionalities. While there are no compromises on functionality, the software does require a high upfront investment and long development time.

- Decentro: A cloud-based debt collection with a strong emphasis on compliance and data security, Decentro is a great choice for businesses prioritising legal risk reduction and easy access through cloud deployment.

- Banksoft: It specialises in debt collection software specifically designed for the financial industry, offering features relevant to banks and financial institutions like loan management and regulatory compliance tools. If you operate within the financial sector, Banksoft's industry-specific features could be a significant advantage.