India’s Top Finance CRM for Banks, NBFCs & Advisors

Streamline client interaction, manage portfolios, track analytics and much more with India's best finance CRM software!

Financial services crm domain header

Watch the videoTrusted by Indian sales teams who sell to Indian customers

What is

finance CRM?

Finance CRM (customer relationship management) software is designed specifically for banks, investment firms, insurance companies and other financial services firms looking to manage client interactions.

A CRM for financial services provides a centralised platform where all client information related to past interactions, current status, investment preferences, buying history, etc., is stored, managed and analysed, enabling your team to deliver personalised services efficiently and effectively.

Why do you need a CRM system for financial services?

To provide the best customer service to

your prospects and clients, you need to understand their pain points, budget, financial goals, etc.

It's easy (not really) when you manage, say, 10 leads a day, but tracking this data and interacting

with your clients becomes a headache when managing hundreds of prospects and clients daily.

You may be troubled with questions like:

A finance CRM answers these questions and more!

How does finance CRM benefit your business?

Improved client management

A CRM system centralises all client data, including contact and financial holdings information and interaction history. This provides a holistic view of each client, allowing you to tailor your services to their individual needs.

Genuine and long-lasting relationships

You can easily interact and follow up with clients promptly, fostering stronger relationships and enhancing trust and loyalty.

Streamlined workflows

CRMs automate various tasks, such as lead capturing, automating WhatsApp messages, scheduling follow-up reminders, etc. This frees up valuable time for financial advisors and professionals to focus on providing quality services to their clients.

Data-driven decision-making

It provides valuable insights into deal closures, client behaviour and their financial goals. The resulting data can be used to identify upselling opportunities, personalise marketing campaigns and make informed decisions.

10 must-have features in finance CRM

Central Data Hub

Capture the right information

Without the right information, you will have no idea who the qualified leads are

- Capture leads’ CIBIL score, phone number and bank preference in one place

- Filter relevant prospects for a callback based on gathered data

- Close more deals

Data Management

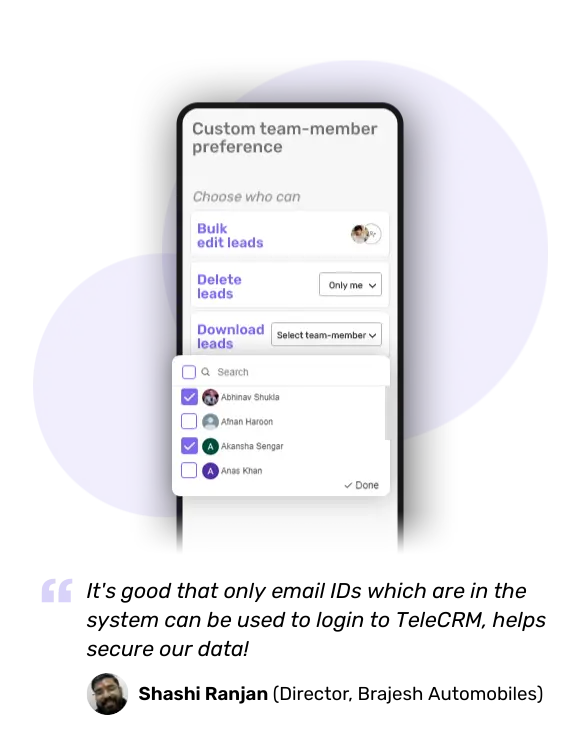

Protect sensitive client information

You might have a lot of deals in the pipeline, but if sensitive customer data is leaked, your competitors could steal your deals

- Hide sensitive data from callers

- Control which team members can access leads

- Safeguard your sales pipeline with robust security measures

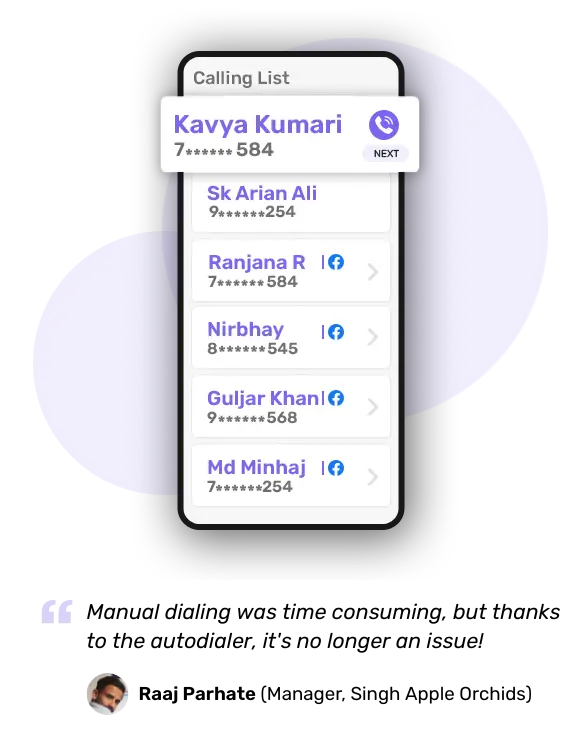

1-click dialer

Boost caller productivity

Because manually dialling numbers leads to confusion and lost time

- 1-click dialer increases agents’ speed, efficiency and accuracy when contacting leads

- They become more productive and, thus, close more deals

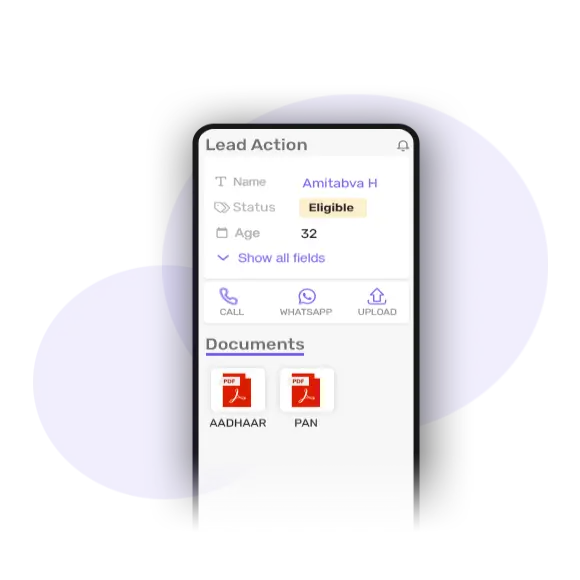

Document Management

Collect verification/KYC documents in one place

Because digging through your hard drive and WhatsApp chats, or repeatedly requesting customers for their documents, is not the best use of your agent’s time

- Store all important documents in one place

- Access those documents anytime, anywhere

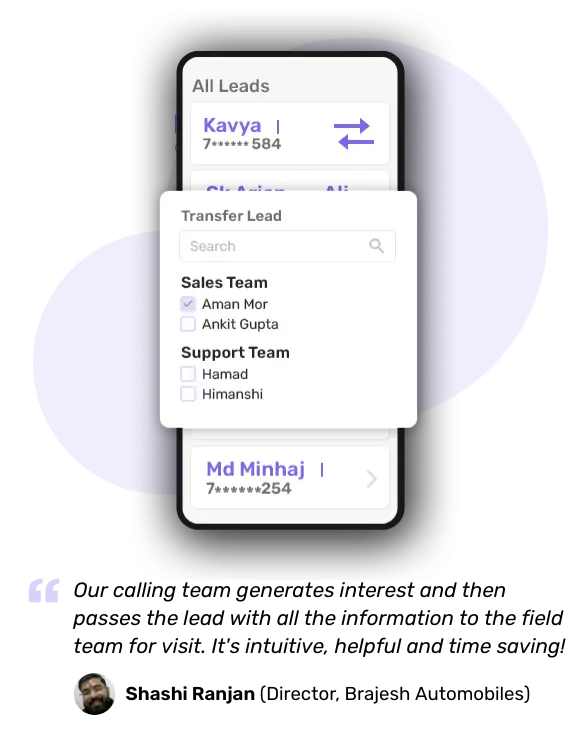

Team Management

Transfer leads at the snap of a finger

Because assigning leads through calls, emails, meetings, etc., is a hassle

- Transfer interested leads to senior sales executives instantly

- Help them close deals faster by letting them access all relevant information in one place

Call Recording

Track all call recordings from one location

Because without call recordings you won't be able to gauge how your agents are performing

- Automatically record all of your agents’ conversations

- Access the recordings anytime, anywhere

- Train your agents more effectively by tracking their mistakes

Performance Insights

Track team performance accurately

Because you need to know if your agents are doing their job and who's doing the best

- Generate real-time reports with hour-by-hour performance data

- Access your entire team's performance even while you’re on the go

- Track the number of calls made by each agent and the deals closed

Follow-Up Reminders

Never miss follow-ups with reminders

Because missed follow-ups = lost prospects and clients

- Set reminders so you never miss a follow-up

- Receive a notification automatically on WhatsApp when it's time to call

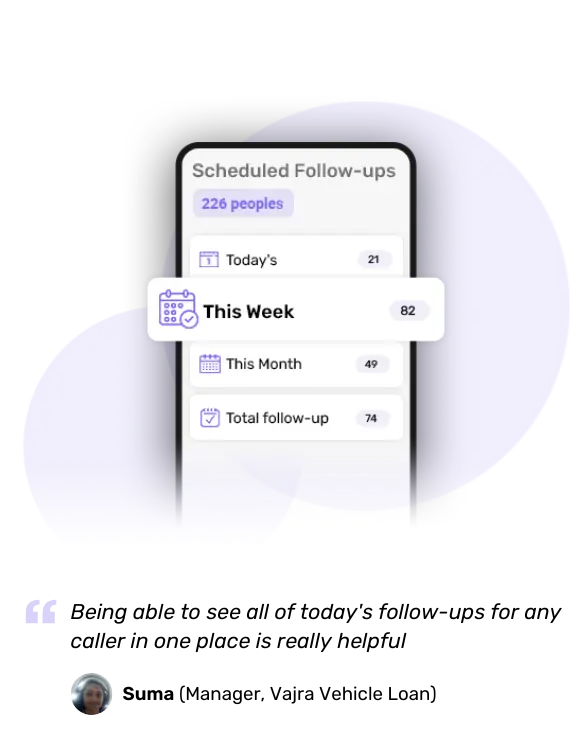

Follow-Up Calendar

Manage follow-ups of agents from one hub

Because if follow-ups are managed manually, they will be missed and deals, lost

- Check all follow-up calls scheduled for a given day/week/month

- Check all missed follow-ups and ensure that your agents take care of them

- Never lose a deal to competition ever again because of a missed follow-up

1-Click WhatsApp/SMS/Email

Interact seamlessly via WhatsApp, email and SMS

Because you need to be where your customers are

- Reach them where they are, without needing any cumbersome integrations

What can a CRM do for finance professionals?

How to choose the best CRM for financial services

Finding a CRM that fits your budget and requirements isn’t that difficult if you keep these six factors in mind.

Easy to use

Choose a CRM that requires minimal training and onboarding time so that you and your team can get started ASAP!

Customisability

Every finserv organisation has its own ways of working. Choose a CRM that can handle and adapt to your specific business processes.

Responsive customer support

A CRM is only as good as its customer support. An amazing CRM with bad support equals lost time, confused reps and eventually lost deals.

Feature-rich

Select a CRM based on the value it provides, not its price.

Mobile Application

The CRM should have a mobile app to track client interactions and preferences, and to engage with them on the go.

Scalable

Your business will grow, so should the CRM. Choose a CRM that is scalable so you don’t have to switch to some other software when your business expands.

Book a free Demo!

Book nowFrequently asked questions

Can’t find what you are looking for? Drop a message on our WhatsApp number.

- telecrm: Highly favoured for its robust telecalling and sales automation capabilities in the financial services industry. It is geared towards simplifying the sales process by automating lead capture from multiple platforms, enabling effective lead distribution and management, and enhancing team productivity with features like the 1-click dialer, conversation history tracking, centralised communication and WhatsApp marketing tools. telecrm is also noted for its excellent mobile app, making it an ideal choice for sales teams that need to manage client interactions and sales activities on the go.

- Zoho CRM: Zoho is renowned for its comprehensive feature set that includes everything from lead and contact management to sales automation and analytics. It offers a highly customisable platform that can scale with your business, making it suitable for financial advisors who need a flexible and powerful CRM system. Zoho also supports a wide range of integrations, enhancing its utility in streamlining various business processes.

- Pipedrive: Known for its user-friendly interface and effective sales management tools, Pipedrive helps financial advisors track and manage their sales processes with ease. Its pipeline management feature lets you easily visualise and move your leads across various stages of the sales funnel.

- Apptivo: This CRM offers a suite of integrated business apps, including capabilities for managing finances, human resources and supply chain in addition to your typical CRM features. Apptivo is great for financial advisors looking for a comprehensive business management solution that includes advanced CRM functionalities like lead management, campaign tracking and detailed analytics.

- Bitrix24: Bitrix24 provides a complete suite of social collaboration, communication and management tools for your team. It includes CRM functionalities like lead management, contact tracking and workflow automation, making it ideal for teams that need a collaborative environment coupled with powerful CRM capabilities to manage client relationships and enhance internal communications.

- Calling management: Financial services CRM systems usually come with an 1-click dialer to automate outbound calls, automatic reminders so your agents never miss follow-ups, call tracking to see exactly what each team member is doing and automatic call recording to track and log every conversation.

- WhatsApp messaging: Connect with customers on WhatsApp and make sure that your follow-up message is seen. You can use official WhatsApp API to send bulk updates and marketing messages and provide support to leads and customers with automated WhatsApp chatbots.

- Automation: Perform all your repetitive tasks with 100% accuracy, and save tons of time. Send WhatsApp welcome messages to leads, auto-assign leads to team members based on predefined logic, schedule automatic renewal reminders, etc.

- Tracking and analytics: Track, monitor and incentivise your team's performance with detailed reports on their performance.

- Integration: It can integrate with 20+ platforms, including your website, Google Ads, to capture leads automatically.

- Instant welcome messages: Schedule automatic welcome messages to new prospects about services, securities, etc., with ease.

- Centralised communication: You can interact with your clients and prospects from one central hub with features like 1-click dialer, Follow-up Reminder, Call Notes, one-click WhatsApp messaging, etc.

- Team management: Manage access to important financial data and decide who gets to access what. This way all your data remains in the hands of the ones you trust.

- Leaderboard: You can track how your reps are performing: number of deals closed, lost, sales numbers of each rep, etc.

- Customisable reports: Generate custom reports on metrics that matter the most for your business, including but not limited to retention rate, revenue growth, cost of customer acquisition, etc. You can then use these reports for better financial planning and to optimise your strategies.