Insurance customers switch between calls, WhatsApp and policy portals, often speaking to different agents each time. But without a unified system that connects and analyses these touchpoints, agents struggle to understand the real reason behind the customer’s latest message or call.

This is because agents can only see the customer’s most recent interaction, not the pattern behind it. So they miss early risk signs like delayed premium payments, repeated queries or frustration in messages, all of which could signal a possible complaint or policy lapse.

Result? Agents end up reacting to each message instead of providing quick and guided solutions.

This is the gap an omnichannel CRM solves. It pulls all interactions into one clear view and uses combined analytics to show customer intent and suggest the next-best action.

In this guide, we will look at what an omnichannel CRM actually is and how it helps insurance businesses deliver faster, proactive and more helpful customer service.

Omnichannel CRM software creates a unified interaction management system that works across every channel. When a customer raises a query on WhatsApp, continues it on a text message and later calls to check the status, the system treats it as one ongoing interaction, not three separate interactions. This ensures the full context, documents, past responses and pending actions stay attached to a single case.

Brands like Allianz, AXA and State Farm use this unified customer view model to maintain complete continuity between sales, service and claims teams.

On top of that, omnichannel customer relationship management software provides insights and analytics that highlight trends, bottlenecks and customer behaviour. This helps managers identify which processes are slowing down and where opportunities for cross-selling or up-selling exist.

In short, it acts as the central hub for the insurance team’s entire lead management system, integrating communication, data tracking, automation and reporting.

While many people in the insurance industry use the terms ‘omnichannel’ and ‘multichannel’ interchangeably, the two are not the same. Knowing the difference and then choosing the right system can change how effectively your team connects with customers.

Here are the key differences between the two:

| Aspect | Omnichannel CRM | Multichannel CRM |

|---|---|---|

| Customer journey view | One unified timeline showing all interactions from every channel | Separate timelines for each channel with no merged view |

| Data structure | Centralised data model that connects every touchpoint | Isolated data for each channel is stored in separate modules |

| Workflow logic | Single workflow applied across all channels | Different workflows and rules per channel |

| Ticket/case management | One ongoing ticket, even when the customer switches channels | Multiple tickets are created when the customer moves across channels |

| Context sharing | Full context available to every agent instantly | Agents must manually check multiple platforms for context |

| Automation features | Cross-channel automation for routing, follow-ups and notifications | Channel-specific automation with limited coordination |

| Customer experience | Continuous, personalised experience with no repetition | Disjointed experience; customers often repeat details |

| Operational efficiency | Faster resolutions, clearer ownership and less duplicate work | Higher chances of confusion, delays and repeated tasks |

| Ideal for | Insurance teams want a seamless customer experience, renewals and claim management | Businesses handling simple, single-channel interactions |

This comparison conveys that, unlike omnichannel CRM, a multichannel CRM stores each interaction in its own structure. Every channel functions with its own rules, its own queue and its own data trail. These systems are not designed to merge customer journeys at the back end.

For insurance teams, this breaks continuity, delays decisions and weakens the personalised experience customers rely on during important financial interactions.

That’s why more insurance teams are moving towards omni-channel CRM to build connections that can boost policy renewals and sales conversions.

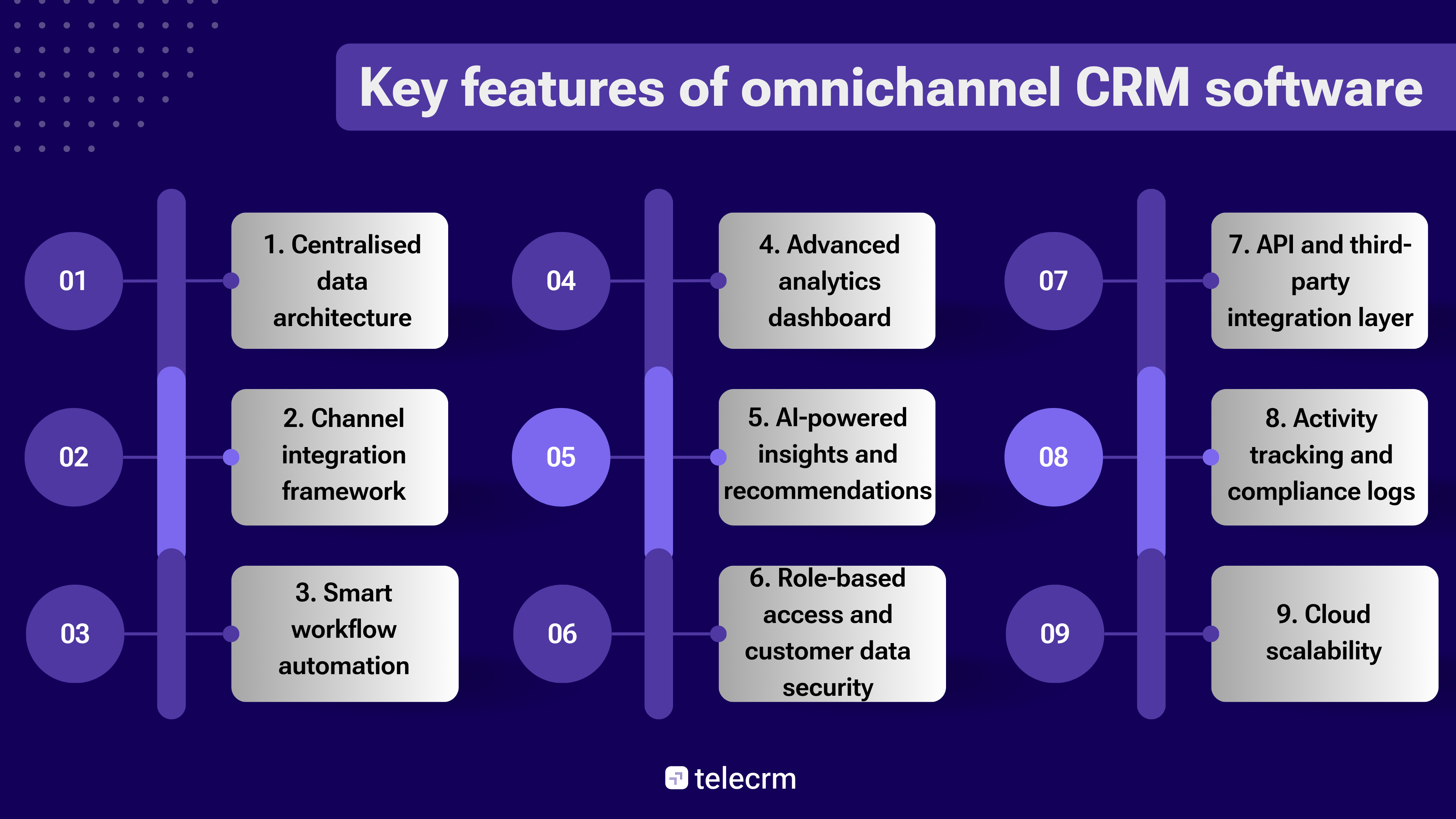

Omnichannel CRM software is built with advanced features that make data management and communication work together in real time.

Here’s a closer look at the key ones:

All customer records, including policy details, claims, communication logs and transaction history, are stored in a single, cloud-based repository. This architecture eliminates data silos and ensures every update made by one agent is reflected across all departments instantly.

The system connects with multiple communication channels such as telephony, WhatsApp, social media, chat and SMS through API integrations. Every message or call is automatically updated inside the system, so no matter which channel the customer uses, the full conversation history stays in one view.

Repetitive tasks such as sending renewal reminders, claim follow-ups or lead assignments can be automated. For example, when a customer’s policy approaches expiry, the CRM can auto-trigger reminders or assign renewal tasks to specific agents.

Also Read: Insurance Workflow Automation: Benefits, Challenges and Best Practices

Omnichannel CRM software comes with analytical tools that process customer and operational data to generate real-time dashboards and reports.

Managers can see important data, like response times, claim progress and agent performance, in easy-to-read dashboards. This helps track what’s working well and where improvements are needed.

Some CRM platforms allow insurance teams to use artificial intelligence to study customer behaviour and gain actionable insights. For instance, AI can suggest the best time to contact a client or identify chances to upsell or cross-sell new policies.

To protect sensitive information, CRM enables businesses to define access levels for each role. So a sales agent can see policy details, while only managers can access full claim documents. This helps maintain both privacy and compliance.

Omnichannel CRM platform supports seamless integration with core insurance applications such as policy management systems, payment gateways and document verification tools. This further reduces manual work since all information flows automatically between systems.

Every call, message or data change is recorded with a date and time. This makes it easier to track communication history, monitor team accountability and meet industry rules like those set by IRDAI or GDPR.

Modern omnichannel CRM solutions are hosted on a scalable cloud infrastructure. So insurance companies can easily handle large amounts of data and work smoothly from anywhere, even as their customer base grows.

There often comes a point when traditional systems and manual tracking start holding you back more than helping you move forward. Below are a few clear signs that it’s time to move to an omnichannel CRM system and how it helps solve each challenge:

As incoming insurance enquiries grow, it becomes difficult to track who is responsible for each request. Without a central business system, multiple agents may respond to the same enquiry unknowingly or some enquiries may be overlooked entirely. This creates internal confusion and makes it difficult to maintain clear accountability for every customer interaction.

An omnichannel CRM solves this by using intelligent routing to assign ownership automatically based on roles, expertise or workload. This keeps every interaction accounted for, even as volumes continue to rise.

Insurance teams spend significant time on repetitive administrative work such as updating spreadsheets, manually logging documents, sending internal status emails or chasing approvals. This not only drains productivity but also increases operational costs and delays service delivery.

An omnichannel CRM automates these routine administrative tasks by capturing every document upload, call note, verification step and status update in a central, real-time system. Notifications, approvals and task assignments are automated, freeing teams to focus on high-value activities.

This reduces operational overhead, speeds up processing and allows your staff to work more efficiently without adding resources.

Policy renewals and cross-selling strategies support steady revenue growth, but a major challenge is that agents often discover a customer’s intent not to renew only at the last moment. Subtle changes in customer behaviour, such as slower replies or missed steps in the renewal journey, often go unnoticed. When intent is spotted late, agents have little time to recover the relationship and offers that could have saved the policy.

But an omnichannel CRM addresses this by tracking behavioural patterns across multiple channels and converting them into an early renewal-intent indicator. This gives agents timely visibility into which customers are drifting away, allowing them to intervene with the right message at the right moment and improve renewal outcomes.

Insurance businesses face strict regulatory documentation and need complete visibility over customer communications.

But during handoffs between underwriting, servicing, claims or grievance teams, critical context can get lost because every team records information differently. So when audits or compliance checks come up, reconstructing the complete case history becomes slow, stressful and error-prone.

Here, an omnichannel CRM provides auto-generated audit trails by logging every action — messages, call notes, approvals, edits, document exchanges — with timestamps, IP logs and agent identities. Since the entire case history travels with the customer in real time, compliance teams get a complete timeline instantly instead of piecing together information from different teams.

Without the right tracking tools, it’s hard to see how your team is truly performing. When managers rely on manual reports, they only see issues after customers complain. This reactive approach makes it difficult to identify where processes are slowing down.

An omnichannel CRM includes real-time operational analytics, showing:

These insights help managers reassign tasks instantly, identify bottlenecks early and improve overall efficiency without waiting for weekly reports.

When insurers add new channels like WhatsApp, chatbots or social platforms, traditional CRMs often fail to recognise that the same customer is interacting from different places. As channel count grows, this leads to a surge in duplicate customer profiles and scattered histories, making it harder to maintain a clean and scalable database.

But omnichannel CRM is built to handle this complexity. It allows new channels to plug directly into a unified platform without disrupting existing systems. Also, all interactions are automatically linked to the correct customer profile in real-time. This keeps identities unified and allows your channel expansion to further scale smoothly without creating database clutter.

The true value of omnichannel CRM goes far beyond simplifying daily operations.

An omnichannel solution actually reshapes how your business functions. It’s not just about managing information better but about transforming how every part of your organisation works together to deliver value.

Here are some of the key benefits that come from adopting an omnichannel CRM:

Insurance customers often engage across multiple touchpoints such as WhatsApp, chatbot, web forms, branch visits, IVR systems and phone calls.

An omnichannel CRM uses identity stitching to merge all these touchpoints into a single customer identity and enables:

As a result, customers are more likely to renew policies, consider add-on coverage and recommend your services to others. This reliable insurance policyholder engagement transforms everyday transactions into stronger customer relationships that drive repeat business and sustainable growth.

Omnichannel CRMs collect behavioural, transactional and interaction-level data from every channel to turn it into predictive intelligence.

Such insurance-specific analytics helps you uncover:

With this clear picture of performance, insurance sales teams’ strategies can be executed more effectively, leading to a real competitive advantage in the market.

Insurance teams often waste time switching channels, duplicating outreach and replying from multiple inboxes. So an omnichannel CRM provides channel intelligence that determines:

This ensures every interaction happens on the right channel, at the right time, reducing operational burden while boosting engagement quality.

Insurance operations depend on process accuracy. An error in documentation, missed verification or delayed claim update can harm customer trust.

Omnichannel CRM provides real-time operational intelligence, including:

This ensures operations run at consistently high standards, with issues detected before they escalate.

The result: faster claims, smoother onboarding and higher customer satisfaction.

Renewals account for a major share of insurance revenue. Yet lapses occur due to missed reminders, poor timing or generic outreach. An omnichannel CRM leverages AI-driven insights to:

This makes renewals and cross-sell proactive rather than reactive, improving revenue consistency and reducing customer turnover.

Not all CRMs are the same and choosing the right one can shape how smoothly your insurance team works. Here’s how to choose wisely:

Before looking at CRMs, think about how your team currently manages policies, claims and customer questions. Identify where each channel operates independently and creates communication gaps.

For example, are follow-ups missed? Do customers have to repeat themselves? Are renewals delayed?

Knowing exactly what your team struggles with helps you pick a CRM that directly solves those problems, instead of buying something you don’t fully need.

Make sure your CRM connects smoothly with your current tools like policy systems, messaging apps or helpdesk software.

If it doesn’t, your team will spend extra time switching between various channels, which can lead to mistakes and slower responses. A CRM that integrates well keeps all customer data in one place, saves time and makes it easier to give a consistent experience to your clients.

Look for a CRM that automates daily manual activities and lets you set up workflows the way your business naturally works.

Ask yourself:

A CRM that adapts to your process keeps operations smooth and allows your agents to focus on helping clients instead of doing repetitive tasks.

A good CRM should show you what’s happening in your business at a glance. For example, you should see which leads are most active, which policies are about to expire or which customer service agents are responding quickly.

This helps managers spot problems early and make smarter decisions. So if one campaign isn’t bringing results, they can adjust it immediately rather than waiting until it’s too late. Such data-driven decision-making helps in faster and accurate planning.

Even the best CRM does not help if your team can’t use it. Make sure the system is easy to understand, simple to navigate and doesn’t require advanced technical skills.

If it’s complex, agents often revert to old habits, like maintaining separate spreadsheets or manual notes. This prevents the team from using the CRM to its full potential. A user-friendly interface encourages faster adoption, ensures everyone follows the same workflow and helps your operations run smoothly from day one.

As your insurance business grows, you might add more staff, offices or various communication channels.

Check:

Your CRM should be able to grow with you without slowing down or causing confusion.

The software is important, but the support behind it is equally critical. A reliable provider helps you get started, trains your team and offers ongoing support when issues arise.

Questions to consider:

Picking the right provider ensures your team can use the CRM effectively and continue improving as your business grows.

telecrm is built from the ground up for insurance businesses, not just general sales teams. It’s designed around the real challenges that agents, brokers and aggregators face every day.

Unlike generic CRMs that require endless customisation before they start making sense, telecrm’s intuitive interface fits naturally into the way your business already operates.

Key features of telecrm include:

WhatsApp outreach-automation – Engage customers instantly through automated WhatsApp reminders, follow-ups and personalised message flows without manual effort

AI-powered lead scoring – Identify high-value prospects by analysing customer behaviour and prioritising leads most likely to convert

Smart call tracking – Monitor call logs, durations and results to measure agent productivity and ensure follow-ups are never missed

Custom workflow builder – Set up tailored workflows for claims, renewals or approvals to ensure timely actions and seamless communication

API & third-party integration layer – Easily connect telecrm with policy systems, chat apps and analytics tools for full interoperability

Audit-trail logging – Every action, message and document upload is logged with timestamp and user for better accountability and regulatory compliance

Easy scalability – Handle high volumes of customer interactions across multiple locations without any performance loss

Advanced analytics dashboard – Get real-time insights into team performance, lead status and campaign results with easy-to-read reports

Book a free demo now to discover how effortlessly telecrm fits your business.

In insurance, personalised customer engagement is key to trust, loyalty and repeat business. But this requires agents to instantly understand customers’ intent, urgency and history across every touchpoint.

Traditional CRM tools fail here because they only store data. They cannot connect interactions across channels, interpret customer needs or guide agents on what should happen next.

Whereas omnichannel CRM comes with predictive intelligence that flags concerns, decodes customer intent and guides agents toward the most appropriate response. This helps your team resolve queries faster, make informed decisions and deliver consistent personalised service.

And telecrm built specifically for insurance workflows, puts all of this into action effortlessly. This is because it is fast to implement and easy to adopt, which further allows your team to start seeing measurable results almost immediately.

The best thing about telecrm? You can experience it yourself by booking a demo today.

© Copyright 2026 telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C