A lot of financial services teams are actively using WhatsApp these days to stay connected with clients and share important updates.

The problem starts when all of this happens manually and without any central system. Messages sit on individual phones. Follow-ups depend on memory. And there’s little visibility into what’s actually happening across leads.

If you’re working this way, you’re more likely to miss follow-ups and create an uneven experience for your clients.

This is where a WhatsApp CRM finance tool helps. It brings WhatsApp conversations into one place, making them easier to track. It also helps automate processes and gives managers better visibility into what’s happening.

In this blog, we’ll look at what a WhatsApp CRM for finance is, why financial teams use it, common use cases and the best CRM tools for managing WhatsApp communication effectively.

A WhatsApp CRM (customer relationship management) for finance is software that connects your WhatsApp Business account and gives you tools to track and manage every lead, conversation and client interaction. Instead of chats sitting on individual phones, everything stays organised in one place.

This means every loan query, payment reminder or service update sent on WhatsApp automatically gets logged in your CRM. That way, your team can instantly see who replied, what was discussed and what needs a follow-up.

Unlike generic CRMs that only track calls and emails or WhatsApp Business that just sends messages, a WhatsApp CRM gives you both: personalised client conversations plus full visibility and automation.

If your team only uses WhatsApp, nothing gets tracked. You can’t see follow-up history, team activity or customer behaviour patterns. And if you’re using a generic CRM system, you still face the same issue in a different form.

That’s where a WhatsApp CRM changes everything. It brings everything together and solves the problems that slow teams down. Let’s take a look:

When multiple agents handle clients from separate WhatsApp numbers, there’s no single view of what’s happening. Two agents might follow up with the same lead or worse, no one does. Managers can’t see who said what or if follow-ups actually happened.

A WhatsApp CRM brings every chat and update into one shared team inbox, so everyone knows the context and can respond properly.

Without knowing who’s paid, what’s pending or who’s at which stage, teams often end up sending bulk messages to everyone. Over time, these messages get ignored or flagged as spam.

With a WhatsApp CRM, messages are sent based on client status. For example, payment updates go only to clients with pending dues, while document reminders go to those who haven’t submitted them yet.

Compliance isn’t just about security. It’s about having proper processes, clear records and accountability. When you rely only on WhatsApp, security at a message level is usually not an issue because of end to end encryption. The bigger problem is everything around it. There’s no clear control over who can access data, where conversations are stored or whether records can be reviewed or audited later.

A CRM system doesn’t just organise conversations; it also helps teams maintain proper records and work in line with data protection and compliance requirements.

If you’re not tracking client communication, it’s hard to know what’s actually working. You can’t see how quickly teams respond, which follow-ups are getting replies or where conversations are dropping off.

A WhatsApp CRM helps you track these basics. You can see response times, follow-up activity and how WhatsApp conversations move leads forward. This makes it easier to spot gaps early and fix them instead of guessing what went wrong.

Taking follow-ups manually isn’t easy. It takes time and chances are you’ll miss a few things along the way. And if a follow-up is missed or delayed, it can easily cost you your leads or hurt client trust.

A WhatsApp CRM automates follow-ups and removes these risks. Reminders go out at the right time. For example, sending renewal reminders before a policy or loan term expires.

In finance, clients want clarity fast. They expect quick answers, clear updates and absolutely no confusion, especially when money is involved.

And since most of these conversations now start on WhatsApp, you need a system that can keep up. That’s exactly where a WhatsApp CRM helps. Here’s what it can do at different stages:

When someone is exploring loans, insurance or investment options with a bank or investment firm, they will have questions about rates, eligibility, documents and benefits. If they don’t get a quick response, they will just move to the next provider.

CRM helps you reply instantly to customer questions, share information they need and qualify leads before they go cold. Auto responses handle repetitive tasks like answering FAQs and collecting basic details. Multimedia support lets you share brochures and other content easily. You can also route hot enquiries to the right agent and run simple financial service WhatsApp marketing flows to keep the conversation moving.

This keeps leads warm and reduces drop-offs caused by slow replies.

Related read: Insurance Workflow Automation: Benefits, Challenges and Best Practices

Once a customer decides to proceed, the back-and-forth begins. Document uploads, KYC checks, income proofs, bank statements, all of this usually gets scattered across messages and missed calls.

With a WhatsApp CRM, updates and requests happen in real time. Agents can share checklists, request documents, confirm submissions and clear doubts quickly. This reduces delays and helps clients complete the process faster without repeated reminders or confusion.

After a loan gets approved or a policy goes live, clients always want to know what happens next. And instead of dumping everything in one long message, you can use WhatsApp drip campaigns in fintech to walk them through things step by step.

You can send welcome messages, quick explainers, key terms and the next steps with clear timelines. This way, onboarding feels easy, happens in the right order and clients stay informed without pinging you every time.

Reminders are a constant thing. When you handle them manually, they drain hours and still get missed. Automated reminders and timely alerts sent through a WhatsApp CRM take over this job and make sure clients hear from you at the right time.

You can automate things like:

This not only improves collection rates but also reduces the manual workload your team deals with every day.

It’s important to engage with clients from time to time and this is where a CRM system really helps. You can nurture clients based on what they’re actually interested in. This could include cross-sell or upsell, like suggesting insurance add-ons after a health policy. You can also use behaviour-based triggers like sending a quick update when their SIP date is near or when the market moves. Another option is sending periodic WhatsApp personalised finance messages like portfolio summaries, tax reminders or market snapshots.

This kind of engagement keeps clients connected and builds trust over time.

Many times, when a query comes in, more than one person ends up handling it. One agent tries to figure out what was said earlier and the client ends up repeating the same thing again. With a WhatsApp CRM, you get one shared inbox. Everyone sees the full chat history and knows exactly what’s going on. As a result, issues get handled faster.

You can also use a chatbot to answer basic FAQs instantly. And to collect feedback after an issue is resolved, you can set up automatic surveys.

You already know that sending messages to hundreds of clients manually isn’t practical. And when you send the same update to everyone, it rarely works and feels spammy. For example, some teams send KYC or re-verification reminders to all clients. But if someone has already updated their details, seeing that message again just feels irrelevant.

This is where WhatsApp bulk messaging for fintech helps. You can segment clients and create proper broadcast lists. This way, each update goes only to the clients who actually need it, without you typing everything again and again.

Related read: 10 Customer Retention Strategies in Finance to Retain Loyal Customers

Choosing the right WhatsApp CRM isn’t about picking the tool with the most features. Finance teams work differently. Lending, insurance, and advisory teams all use WhatsApp in their own ways, so the CRM has to reflect how your team actually operates.

CRMs vary just as much. Some rely on third-party WhatsApp connectors, others offer different levels of automation and not all handle multi-agent or compliance needs well.

Before shortlisting anything, think about how your team communicates, the WhatsApp volume you manage each day and the level of automation or visibility you really need.

Here are some top options to help you decide:

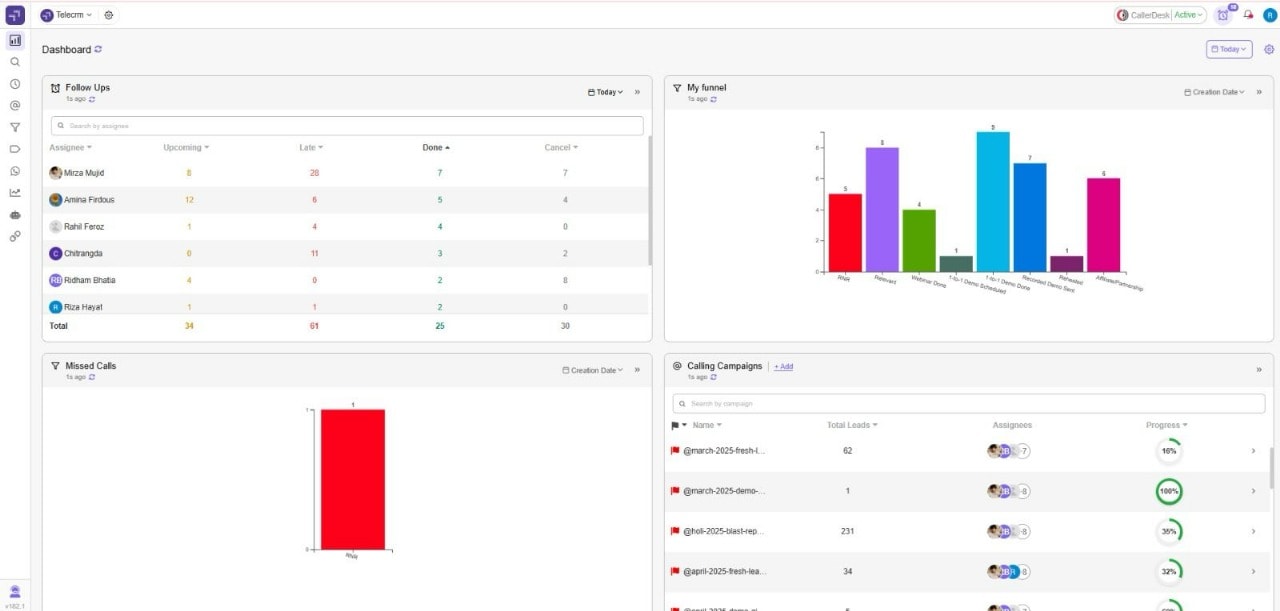

telecrm is an easy-to-use cloud-based WhatsApp CRM designed for financial service teams — from banks and NBFCs to advisors and fintech firms. It helps your team handle WhatsApp conversations, automate follow-ups and track conversions without juggling multiple tools.

Integration is done through the official WhatsApp Cloud API, so everything stays secure and compliant.

Key features:

Best for: Finance teams that use WhatsApp extensively for sales, marketing and day-to-day client work like loan follow-ups, KYC, renewals and more. If you need tight multi-agent coordination, reliable automation and stronger financial customer engagement on WhatsApp, telecrm is a solid pick.

HubSpot CRM is an easy-to-use platform that unites sales, marketing and customer service. It’s widely adopted across industries and works well for financial firms that want strong automation and advanced marketing capabilities.

Key features:

Best for: Mid-sized to large financial institutions looking for an all-in-one CRM system with advanced automation and customer engagement features. If you already use HubSpot for marketing or customer service, adding WhatsApp gives you a fully connected system for campaigns, renewals and client support but it’s best suited for teams with a solid tech setup and budget.

Zoho CRM is a cloud-based customer relationship platform designed to manage sales, leads, contacts and client interactions across multiple channels. It also offers dedicated solutions for the financial services industry.

Key features:

Best for: Financial service teams that manage clients on WhatsApp, calls and email and need automation, compliance and easy tracking in one place.

Bitrix24 is a complete business management suite that combines CRM, team collaboration and project management tools. It’s especially useful for financial firms that want to manage clients, internal teams and communication within one platform instead of juggling multiple apps.

Key features:

Best for: Finance professionals that handle high client volumes and need both customer communication and internal coordination tools in one platform.

Freshsales by Freshworks is a modern CRM platform that supports sales, marketing and customer support workflows. It is powered by AI for smarter lead management, forecasting and customer engagement.

Key features:

Best for: Mid-size financial firms that need a CRM system with strong communication tools and AI features.

Integrating WhatsApp with your CRM is one of the simplest ways to streamline operations and fix how your finance team communicates and follows up. You get visibility across every chat, every update and every stage of a client’s journey. For finance teams, this alone makes a huge difference in response times, conversions and overall workflow.

So, if you’re trying to organise your WhatsApp communication and improve customer engagement and retention, moving to a WhatsApp CRM for finance is the next logical step. Look for something built for finance workflows, not a generic tool.

telecrm is one option that ticks those boxes with automation, multi-agent handling and simple tracking. If you want to see how this fits into your workflow, book a demo today and try it out.

© Copyright 2026 telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C